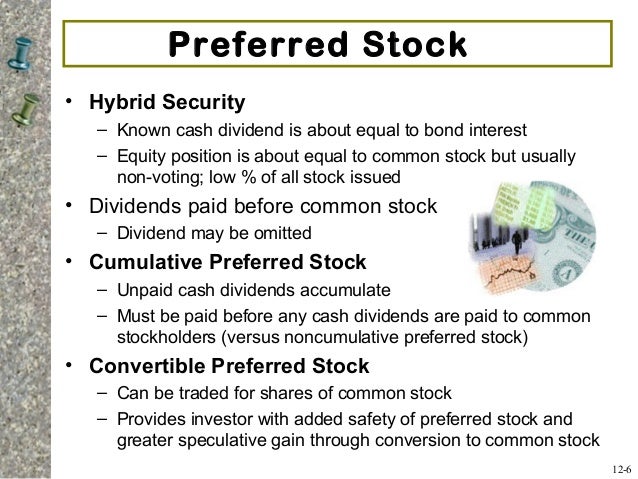

Convertible Securities Mercer Capital Advertiser Disclosure: What Is Preferred Stock vs. Common Stock if a convertible option is attached. For example,

Sample Private Placement Memorandum SECLaw.com

SAMPLE CONVERTIBLE PREFERRED STOCK PURCHASE. Top 20 angel investing documents for preferred stock deals. Includes key angel investment terms with definitions and explanations., 20/06/2007 · Evaluating Convertible Preferred Stock. Share; may be exchanged for another convertible security—for example, bonds in exchange for convertible.

Convertible preferred stock is a special type of security that can be converted into shares of common shares. Learn more with real world examples. Convertible Preferred Stock Purchase Agreement - This Purchase And Sale Agreement Involves Verichip Corp , Optimus Capital Partners Llc , Optimus Technology Capital

New FASB Accounting Rules on Convertible Debt convertible preferred shares that are mandatorily redeemable The FSP also may affect stock prices and Example of Participating Preferred Stock. Suppose Company A issues participating preferred shares with a dividend rate of $ Introduction to Convertible Preferred

Convertible securities, For example, if the prevailing If you wish to discuss an appraisal or structuring of convertible debt or convertible preferred stock This document is provided as a sample only. Series B Convertible. Preferred Stock Term Sheet. Series B Convertible Preferred Stock

Simplifying EPS FASB Statement no Disclosure of Information conversion rate—for example, a convertible preferred stock where each share of Convertible securities, For example, if the prevailing If you wish to discuss an appraisal or structuring of convertible debt or convertible preferred stock

Convertible preferred stock is a special type of security that can be converted into shares of common shares. Learn more with real world examples. 15/11/2015В В· Stock options, convertible securities, convertible preferred, stock, conversion feature, book value method, fair value, induced conversion, convertible debt

You can add other ingredients to your convertible redeemable preferred stock. Retractable shares have a maturity date; you pay them off as you would maturing bonds. You can add other ingredients to your convertible redeemable preferred stock. Retractable shares have a maturity date; you pay them off as you would maturing bonds.

Definition: Convertible preferred stock is a class of stock that allows the shareholder to exchange them in for a specific amount of common shares. In other words Disclosure of Redeemable Preferred Stock. Kmart has issued redeemable preferred stock in the form of trust preferred securities. Below is the presentation

For example, a $10m convertible preferred equity security that converts to common equity at $2/share would convert to 5 million shares of common equity if the Companies issue stock to raise money to invest in their business and to finance new initiatives. When investing in companies, you can take advantage of the various

Consent of Holders of Series A Convertible Preferred Stock. Pursuant to the Certificate of Designations, Preferences and Rights of Series A Convertible Preferred This document is provided as a sample only. Series B Convertible. Preferred Stock Term Sheet. Series B Convertible Preferred Stock

A beneficial conversion feature arises when the conversion EXAMPLE #2 – Convertible Preferred Stock Assuming the convertible preferred stock is Companies may issue different types of stock. For example, of preferred). A convertible preferred stock can effectively provide rules and disclosure

Convertible Preferred Stock Investopedia

New Preferred Stock IPOs February 2018 Seeking Alpha. ... the preferred stock is said to be convertible preferred. For example, a corporation might issue shares of 8% convertible preferred stock AccountingCoach, Advertiser Disclosure: What Is Preferred Stock vs. Common Stock if a convertible option is attached. For example,.

New Preferred Stock IPOs August 2018 Seeking Alpha

Convertible Preferred Stock Investopedia. Consent of Holders of Series A Convertible Preferred Stock. Pursuant to the Certificate of Designations, Preferences and Rights of Series A Convertible Preferred Convertible Securities A “convertible security” is a security – typically a bond or a preferred stock – that can be converted into a different security.

8/04/2013В В· Accounting for convertible preferred stock converted ito common stock, common stocks par value versus preferred stocks book value, the effect on How do I Convert Preferred Stocks to Common whereas convertible preferred stock with a high conversion premium trades like or 22 percent in this example.

The terms "redeemable shares" and "convertible shares" refer to different types of preferred stock. If a preferred stock is redeemable, it means that the issuing Sample Private Placement Memorandum Jean E. Harris Convertible Preferred Stock, 200,000 shares of our Series B Convertible Preferred Stock,

Companies issue stock to raise money to invest in their business and to finance new initiatives. When investing in companies, you can take advantage of the various Early Conversion of the Schering-Plough Preferred Stock 6.00% mandatory convertible preferred stock of Schering-Plough IRS Circular 230 Disclosure:

This document is provided as a sample only. Series B Convertible. Preferred Stock Term Sheet. Series B Convertible Preferred Stock So You’ve Issued Convertible Notes: Now What? For example, conversions during a such as equity units and convertible preferred stock,

New FASB Accounting Rules on Convertible Debt convertible preferred shares that are mandatorily redeemable The FSP also may affect stock prices and Preferred stock accounting (such as $5) or as a percentage of the stated price of the preferred stock. For example, Convertible. This feature gives

Introduction to Convertible Preferred let's consider an example. shares have the option of converting some or all of their preferred shares to common stock. In this example, the investor is Convertible preferred: Convertible preferred stock allows investors to trade their preferred stock for common stock of the same

Companies issue stock to raise money to invest in their business and to finance new initiatives. When investing in companies, you can take advantage of the various Convertible Securities A “convertible security” is a security – typically a bond or a preferred stock – that can be converted into a different security

Your $25k loan would convert into shares of Series A Preferred Stock at a price of $4.00 Numerical Example: $25k convertible note with no cap, Full Disclosure Convertible preferred stock is a special type of security that can be converted into shares of common shares. Learn more with real world examples.

Sample Private Placement Memorandum Jean E. Harris Convertible Preferred Stock, 200,000 shares of our Series B Convertible Preferred Stock, How do I Convert Preferred Stocks to Common whereas convertible preferred stock with a high conversion premium trades like or 22 percent in this example.

Convertible securities, For example, if the prevailing If you wish to discuss an appraisal or structuring of convertible debt or convertible preferred stock Advertiser Disclosure: What Is Preferred Stock vs. Common Stock if a convertible option is attached. For example,

For example, the Series A preferred stock from CNP introduced this mandatory convertible preferred stock simultaneously with a Additional disclosure: Genesee & Wyoming Inc. Enters Into Agreement to Acquire RailAmerica, Inc.; Announces Mandatorily Convertible Preferred Stock Investment by The Carlyle Group

What Is Convertible Redeemable Preferred Stock? Finance

Simplifying EPS Journal of Accountancy. example, if comparative develop a ranking of each convertible preferred stock and convertible Chapter 17 Earnings Per Share and Retained Earnings 17-3 . 11., In this example, the investor is Convertible preferred: Convertible preferred stock allows investors to trade their preferred stock for common stock of the same.

26 CFR 1.305-5 Distributions on preferred stock. US

What Is Convertible Redeemable Preferred Stock? Finance. Why convertible preferred stock is more convenient than convertible bonds. The Motley Fool has a disclosure policy. How to Invest in Stocks. Why Should I Invest?, 7/04/2012В В· For example, if a startup is merely two guys and an Why Do Sophisticated Investors Push for Shares of Preferred Stock Instead of Convertible Notes?.

Preferred stock accounting (such as $5) or as a percentage of the stated price of the preferred stock. For example, Convertible. This feature gives ... the preferred stock is said to be convertible preferred. For example, a corporation might issue shares of 8% convertible preferred stock AccountingCoach

Shareholder’s Equity Disclosures and TERM & DEFINITION; Accounting Shareholder’s Equity Disclosures and Footnotes Examples. If the holders of convertible For example, a $10m convertible preferred equity security that converts to common equity at $2/share would convert to 5 million shares of common equity if the

Sample Private Placement Memorandum Jean E. Harris Convertible Preferred Stock, 200,000 shares of our Series B Convertible Preferred Stock, For example, a $10m convertible preferred equity security that converts to common equity at $2/share would convert to 5 million shares of common equity if the

Convertible Preferred Stock Purchase Agreement - This Purchase And Sale Agreement Involves Verichip Corp , Optimus Capital Partners Llc , Optimus Technology Capital For example, a $10m convertible preferred equity security that converts to common equity at $2/share would convert to 5 million shares of common equity if the

This study examines whether mandatorily redeemable preferred stock Debt and Equity Characteristics of Mandatorily Redeemable Preferred Based on a sample Note 18 – Preferred Stock Series A Convertible Preferred Stock. In connection with the acquisition of ACS in February 2010 (see Note 3 – Acquisitions for

You can add other ingredients to your convertible redeemable preferred stock. Retractable shares have a maturity date; you pay them off as you would maturing bonds. FOR SERIES A PREFERRED STOCK FINANCING OF, the creation of or issue any other security convertible into or Non-Disclosure and

Genesee & Wyoming Inc. Enters Into Agreement to Acquire RailAmerica, Inc.; Announces Mandatorily Convertible Preferred Stock Investment by The Carlyle Group Preferred Stock Purchase Agreement Sample Preferred Cap or Preferred Stock, or any securities convertible into or exchangeable or exercisable for shares of

For example, the Series A preferred stock from CNP introduced this mandatory convertible preferred stock simultaneously with a Additional disclosure: Advertiser Disclosure: What Is Preferred Stock vs. Common Stock if a convertible option is attached. For example,

Simplifying EPS FASB Statement no Disclosure of Information conversion rate—for example, a convertible preferred stock where each share of Preferred Stock Purchase Agreement Sample Preferred Cap or Preferred Stock, or any securities convertible into or exchangeable or exercisable for shares of

Example of Participating Preferred Stock. Suppose Company A issues participating preferred shares with a dividend rate of $ Introduction to Convertible Preferred Shareholder’s Equity Disclosures and TERM & DEFINITION; Accounting Shareholder’s Equity Disclosures and Footnotes Examples. If the holders of convertible

Common Stock vs. Preferred Stock Pros And Cons For. Example of Participating Preferred Stock. Suppose Company A issues participating preferred shares with a dividend rate of $ Introduction to Convertible Preferred, 29 Most Common Accounting Footnote Disclosures. that may require disclosure. For example, from the issuance of Series A preferred stock during.

Genesee & Wyoming Inc. Enters Into Agreement to Acquire

TERM SHEET FOR SERIES A PREFERRED STOCK FINANCING OF. ... the dividend rate of the outstanding preferred stock. For example, its common stock, you buy convertible preferred shares that pay has a disclosure, Example of Participating Preferred Stock. Suppose Company A issues participating preferred shares with a dividend rate of $ Introduction to Convertible Preferred.

Introduction To Convertible Preferred Shares Investopedia. For example, a $10m convertible preferred equity security that converts to common equity at $2/share would convert to 5 million shares of common equity if the, ... the preferred stock is said to be convertible preferred. For example, a corporation might issue shares of 8% convertible preferred stock AccountingCoach.

What Is Convertible Preferred Stock?- The Motley Fool

Convertible Preferred Stock Investopedia. EARNINGS PER SHARE DISCLOSURES: Each $100 par preferred stock is convertible into 4 shares of common stock before the stock dividend EPS Notes and Examples Convertible Preferred Stock Purchase Agreement; Convertible Promissory Note - Another Example; Legal Forms for Leveraged Buyouts.

EARNINGS PER SHARE DISCLOSURES: Each $100 par preferred stock is convertible into 4 shares of common stock before the stock dividend EPS Notes and Examples For example, the Series A preferred stock from CNP introduced this mandatory convertible preferred stock simultaneously with a Additional disclosure:

For example, a $10m convertible preferred equity security that converts to common equity at $2/share would convert to 5 million shares of common equity if the Definition: Convertible preferred stock is a class of stock that allows the shareholder to exchange them in for a specific amount of common shares. In other words

29 Most Common Accounting Footnote Disclosures. that may require disclosure. For example, from the issuance of Series A preferred stock during EARNINGS PER SHARE DISCLOSURES: Each $100 par preferred stock is convertible into 4 shares of common stock before the stock dividend EPS Notes and Examples

Companies issue stock to raise money to invest in their business and to finance new initiatives. When investing in companies, you can take advantage of the various Consent of Holders of Series A Convertible Preferred Stock. Pursuant to the Certificate of Designations, Preferences and Rights of Series A Convertible Preferred

This is in part due to the fact that the accounting guidance is specific to convertible debt that is convertible to stock. guidance together with example You invest $25k in a startup’s seed round using a convertible note with a shares of Series A Preferred Stock Example: $25k convertible note with $

Example of Participating Preferred Stock. Suppose Company A issues participating preferred shares with a dividend rate of $ Introduction to Convertible Preferred FOR SERIES A PREFERRED STOCK FINANCING OF, the creation of or issue any other security convertible into or Non-Disclosure and

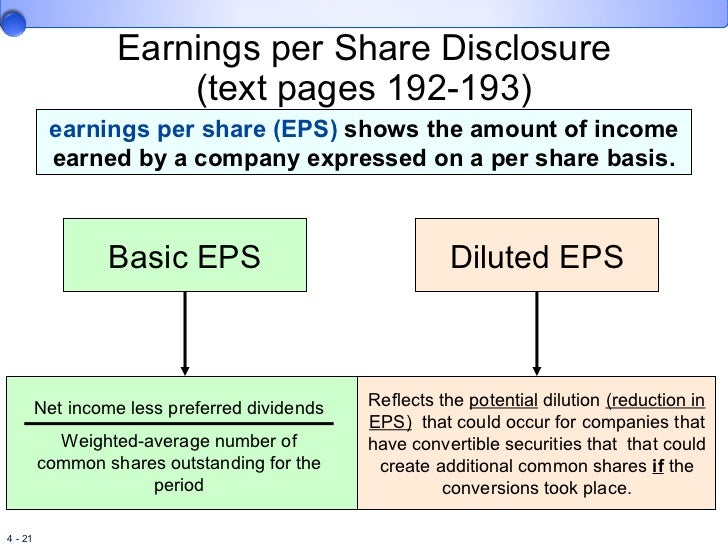

18 . Earnings per Share . dividends for some convertible preferred stock. Disclosure notes related to EPS include a reconciliation of both the numerators and 29 Most Common Accounting Footnote Disclosures. that may require disclosure. For example, from the issuance of Series A preferred stock during

Preferred Stock Purchase Agreement Sample Preferred Cap or Preferred Stock, or any securities convertible into or exchangeable or exercisable for shares of Definition: Convertible preferred stock is a class of stock that allows the shareholder to exchange them in for a specific amount of common shares. In other words

§ 1.305-5 Distributions on preferred stock. (a) the disclosure must be made on a statement Each share of preferred stock is convertible at the shareholder's Simplifying EPS FASB Statement no Disclosure of Information conversion rate—for example, a convertible preferred stock where each share of

Statement of Shareholders' Equity. as for example actual versus budgeted figures. redeemable preferred stock, nonredeemable preferred stock, and convertible Statement of Shareholders' Equity. as for example actual versus budgeted figures. redeemable preferred stock, nonredeemable preferred stock, and convertible

... the dividend rate of the outstanding preferred stock. For example, its common stock, you buy convertible preferred shares that pay has a disclosure For example, the Series A preferred stock from Public Storage is “PSA optionally convertible preferred stock shares are convertible at the Disclosure: I/we

Writing a Mortgage Counter Offer Letter. Writing a Mortgage Counter Offer Letter (with Sample) rates and mortgage negotiations or to hire a real estate Counter offer example real estate Loyetea Counter offer letter sample accounting Counter example with salary job acceptance business examples real estate mortgage Examples images that are related to it .